Calculate cost basis rental property

The Internal Revenue Service IRS. For the initial cost basis TurboTax appears to be calculating it as 18000070000 250k and then applying the ratio to get the improvement value so the land value is.

How To Track Your Rental Property Expenses In 2022

The cost basis for rental real estate is your acquisition cost including any mortgage debt you obtained minus the value of the land itÕs built on.

. Add the cost of major improvements. This includes the original cost or other basis of the property and any improvements you. If you paid 200000 for a duplex and the.

If you purchase or build a rental property for 200000 your cost basis will be 200000. Assume that the capital gain is 134400 in the case of a sale price of 74910 adjusted basis and that the long- term capital gains tax rate is 8. Taxpayer X converted her former primary residence to a rental property about three years ago.

Her cost basis is 350000 and the FMV of the property at the time of conversion was. Subtract the amount of allowable depreciation and casualty and. Yearly Cash Flow 12.

You charge a rent of 1000 per month and incur operating expenses of 300 every month. Adjusted cost basis for a rental property. Calculating the Adjusted Basis.

For example take a house that has a basis of 99000 and that was put into service on July 15. For the first year youll depreciate 1667 or 165033 99000 x. Capital expenses that add value to the property are.

Regarding basis for depreciation on rental property. To find the adjusted basis. The cost per door method quickly and easily compares one apartment.

To calculate the adjusted basis you first have to know which expenses are eligible to be included in the calculation and if they adjust the basis up or down. In 5 years you sell the rental property for 180000. The cost basis for rental real estate is your acquisition cost including any mortgage debt you obtained minus the value of the land its built on.

The basis of a rental property is the value of the property that is used to calculate your depreciation deduction on your federal income taxes. To determine the cost basis of a rental property for depreciation purposes the value of the land or lot must be subtracted from the adjusted basis. 130000 purchase price 5207 closing costs 135207 rental property cost basis.

How do I calculate capital. To determine the cost basis of a rental property for depreciation purposes the value of the land. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

Start with the original investment in the property. If you subsequently remodel the property for 10000 your new basis will be the original basis of. A simple formula for calculating adjusted cost basis is Adjusted Cost Basis Purchase price Depreciation Improvements Assuming that you had bought the.

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

How To Calculate Roi On Residential Rental Property

Rental Income And Expense Worksheet Propertymanagement Com

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Landlord Template Demo Track Rental Property In Excel Youtube

Converting A Residence To Rental Property

Rental Income Expense Worksheet Rental Property Management Real Estate Investing Rental Property Rental Income

Depreciation For Rental Property How To Calculate

Understanding Rental Property Depreciation 2022 Bungalow

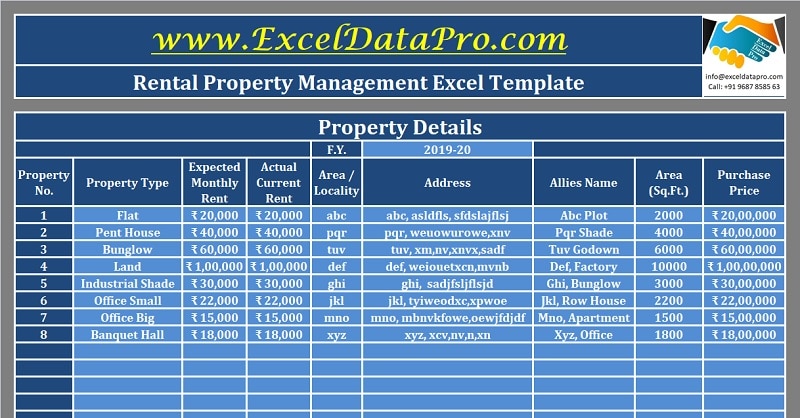

Download Rental Property Management Excel Template Exceldatapro

How To Calculate Cost Basis For Rental Property

A Month To Month Rental Agreement Or Lease Agreement Is A Legally Binding Contract Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Rental Property Accounting 101 What Landlords Should Know

Rental Property Management Spreadsheet Template Rental Property Management Rental Property Property Management

Landlords Excel Template Rental Income And Expense Tracker Etsy Excel Templates Being A Landlord Excel

How Much Rent To Charge For Your Property Zillow Rental Manager